GSTR-2A Reconciliation in TallyPrime

New Access Technologies offers the most powerful and Advanced GSTR-2A Reconciliation in TallyPrime that comes packed with 5X faster GST reconciliation and intelligence to auto-identify, match entries and assure 100% ITC claim.

GSTR-2B Reconciliation in TallyPrime primarily involves matching the data uploaded by the suppliers with those of the recipient’s purchase data. This basically includes comparing the GSTR-2A auto-populated from suppliers data and the purchase data recorded by the receiver of the supplies. This matching concept also ensures that all the transactions which took place in a particular period have been recorded.

GSTR-2A is an auto-generated read only document which is for information purpose only. GSTR-2B is a new static month-wise auto-drafted statement for regular taxpayers (whether or not opted into the QRMP scheme) introduced on the GST portal. The statement was launched from the August 2020 tax period onwards.

GSTR-2B provides eligible and ineligible Input Tax Credit (ITC) for each month, similar to GSTR-2A but remains constant or unchanged for a period. In other words, whenever a GSTR-2B for a month is accessed on the GST portal, the data in it remains the same without being changed for subsequent changes by their suppliers in later months.

Benefits of GST Reconciliation in Tally

The data in GSTR-2B Reconciliation Report in Tally is reported in a manner that allows taxpayers to conveniently reconcile ITC with their own books of accounts and records. It will help them in easier identification of documents to ensure the following:

- The input tax credit is not availed twice against a particular document.

- The tax credit is reversed as per the GST law in their GSTR-3B, wherever required

- Sometimes, it happens that the vendor has declared his GST liability and credit has not been availed by the purchaser in his GST returns. So, not to lose the claim of ITC, the data should be reconciled on a regular basis. This reconciliation process will ensure no ITC loss on any invoices.

- Under new GST returns, the taxpayers will only be able to claim ITC if the particular invoice is present in the GSTR-BA or supplier’s data. This requirement forces the businesses to reconcile and claim ITC correctly

How to do GST Reconciliation in TallyPrime

Follow these steps for reconciliation in tally using Live GST Reconciliation Module

- 1.Gate Way of Tally > Display More Reports > GST Reports.

- 2.Select the Portal Credential option to enter your GST Portal User Name and Accept the screen.

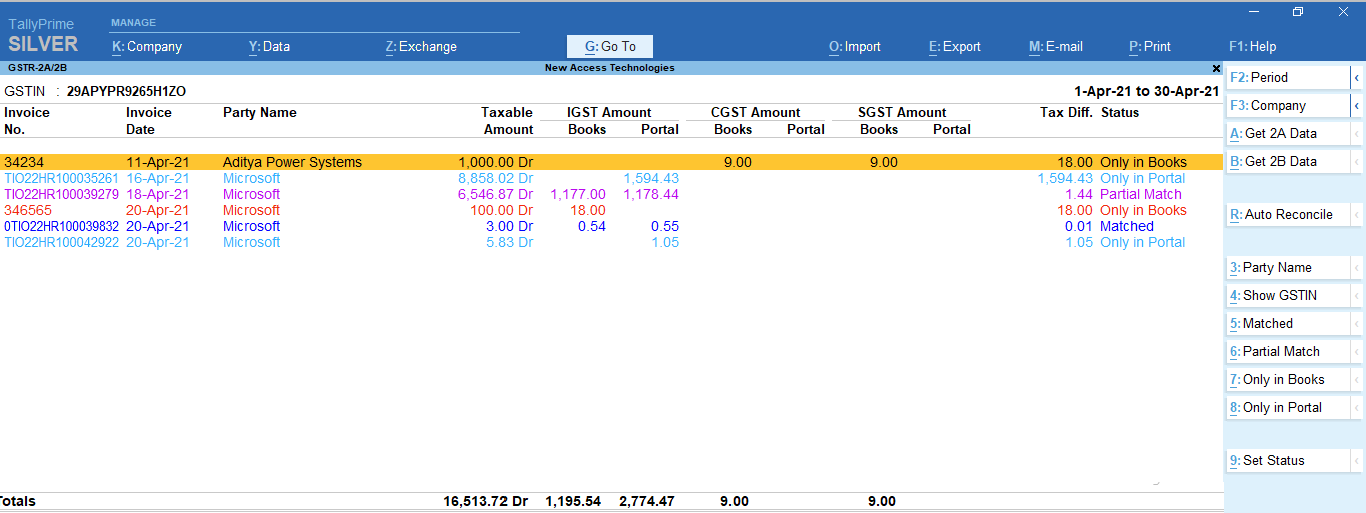

- 3.Now Go to GSTR-2A or GSTR-2B Reconcile Report

- a.Change the Period in Report for Which Month Data you want to Reconcile(ex.01-10-2023-31-10-2023)

- b.Click the Get 2A Data Button.

- c.It Shows OTP Screen, Please enterOTP Received from GSTIN Portal as SMS Or Email.

- d.Now It Starts downloading the Data from the GST Portal and will show how many transactions are imported.

- e.Click the Start Matching Button to Match your Purchase Data with Portal Records.

- f.Now transactions will show status as Matched, partial Match, Only in Books or Only In Portal.

- g. If Everything is correct, then Click the Save Reconcile Button to Complete the Reconciliation of that Month, and Pending Bills will carry forward to Next Month.